09 Jun Bitfinex Alpha | BTC at a Crossroads

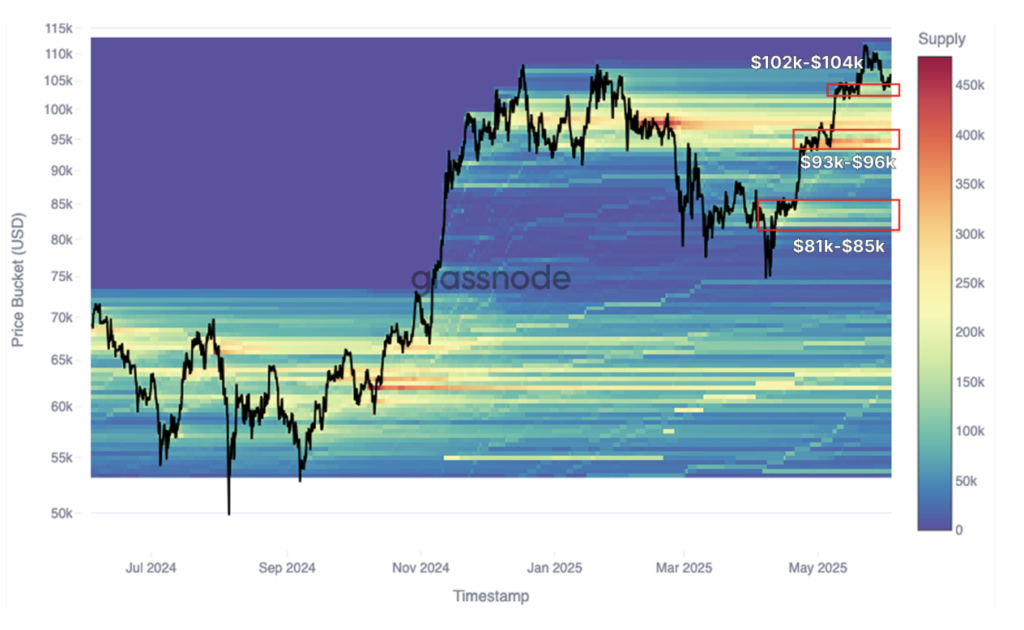

A textbook run-up in Bitcoin fuelled by strong spot demand, profit-taking by long-term holders and a resurgence in macro risk have combined to pull the asset back over 10 percent from its all-time high. The final leg of the decline on June 5th saw over $875 million in long liquidations in a single day—highlighting the extent of deleveraging. With over $1.9 billion in total liquidations across the past week, leverage has now been forcefully reset. Technical structure shows that BTC’s ascent was underpinned by genuine demand, as shown by a spot-led stair-step rally, with key accumulation clusters forming at $93,000–96,000, and $102,000–104,000.

On-chain indicators now point to rising sell pressure as older holders begin to distribute. The Spent Supply Distribution (SSD) quantiles and Short-Term Holder (STH) Cost Basis bands offer a clear roadmap. The SSD 0.95 quantile at $103,700 marks the first support zone, followed by $97,100 (STH Cost Basis) and $95,600 (SSD 0.85), with $83,200 as the key risk-off level. These levels are crucial as they reflect cost basis zones for large holders and recent buyers, serving as potential demand re-entry points or liquidation triggers.

In a nutshell, Bitcoin is now at a crossroads—balanced between structural support and waning bullish momentum, waiting for its next macro cue.

The US macroeconomic landscape continues to show signs of strain as job growth slowed in May, reflecting early pressure from ongoing trade tensions and tariff uncertainty.

While wage gains remained solid, a shrinking labour force and downward revisions to past employment data suggest the labour market’s resilience is beginning to erode. At the same time, both the manufacturing and services sectors contracted, driven by rising input costs and declining demand, underscoring the widespread impact of tariffs across the economy. Construction spending has also declined for three straight months, and inflationary pressures are mounting as businesses struggle to absorb higher costs.

On the trade front, the US deficit narrowed due to falling imports—particularly from China—but this decline signals weakening demand rather than strength, raising concerns about future inventory shortages and inflation. Meanwhile, investor appetite for long-term US debt is faltering, with auction data and futures markets pointing to skepticism about fiscal stability.

Crypto adoption is accelerating on multiple fronts, with IG Group becoming the first UK-listed company to offer spot crypto trading to retail investors. Partnering with Uphold, IG now enables direct purchases of bitcoin and other tokens, marking a shift from speculative derivatives to true asset ownership. This move coincides with the UK Financial Conduct Authority’s proposal to lift its ban on crypto exchange-traded notes (cETNs) for retail investors, signalling broader regulatory support for digital assets. Meanwhile, Japan’s Metaplanet announced a ¥850 billion ($5.4 billion) equity raise to aggressively expand its bitcoin holdings, aiming for 210,000 BTC by 2027—underscoring Asia’s growing role in institutional crypto adoption.