30 Jun What’s new with Honey Framework 3.1.1?

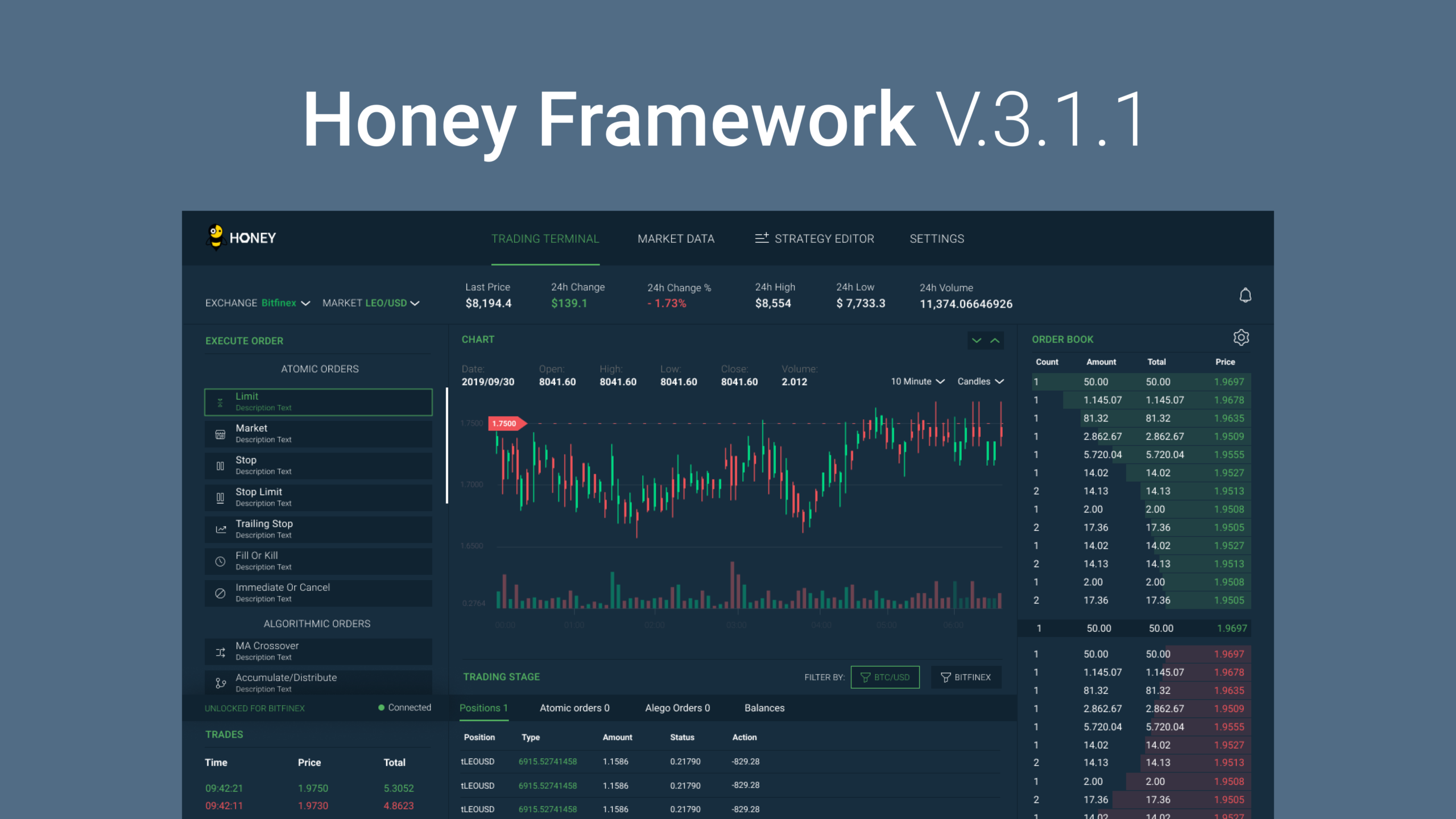

The Honey Framework is a powerful tool that allows users to program their own custom order types and trading strategies. It integrates directly into the bitfinex.com trading interface allowing for a native experience.

This week we are celebrating the release of the Honey Framework UI v3.1.1 which focuses on dramatically improving the strategy creation experience. So… What’s new?

Historical backtesting is here!

We’ve added complex historical backtesting to help users test out their trading strategies before they hit the markets. The new tester allows for custom start/end date ranges, timeframes and can be executed on all Bitfinex supported markets.

Once executing, the UI will automatically download all trades and candles for the provided parameters from the open source bitfinex-ds-server. Then, a detailed report on the performance of your strategy will be produced, helping you to make small profitable adjustments.

The code editors new look

The Honey Framework strategy libraries have tonnes of functionality and documentation. This can cause issues for developers when trying to write a custom strategy. Before users would have to constantly refer to multiple github repos in order to lookup how to use a certain function. To solve this, we have built a ‘Docs’ panel directly into the editing interface to help make this process easier.

Syntax highlighting and hyper links make it easy to read and jump to important references.

Fully customisable trading terminal

To further increase the customisation of the HF UI, we have taken the layout system from the market data page and added it to the trading terminal page as well. This means users can select which market data streams to view when submitting their orders.