29 Dec Tutorial: Getting started with the new V3 Honey Framework

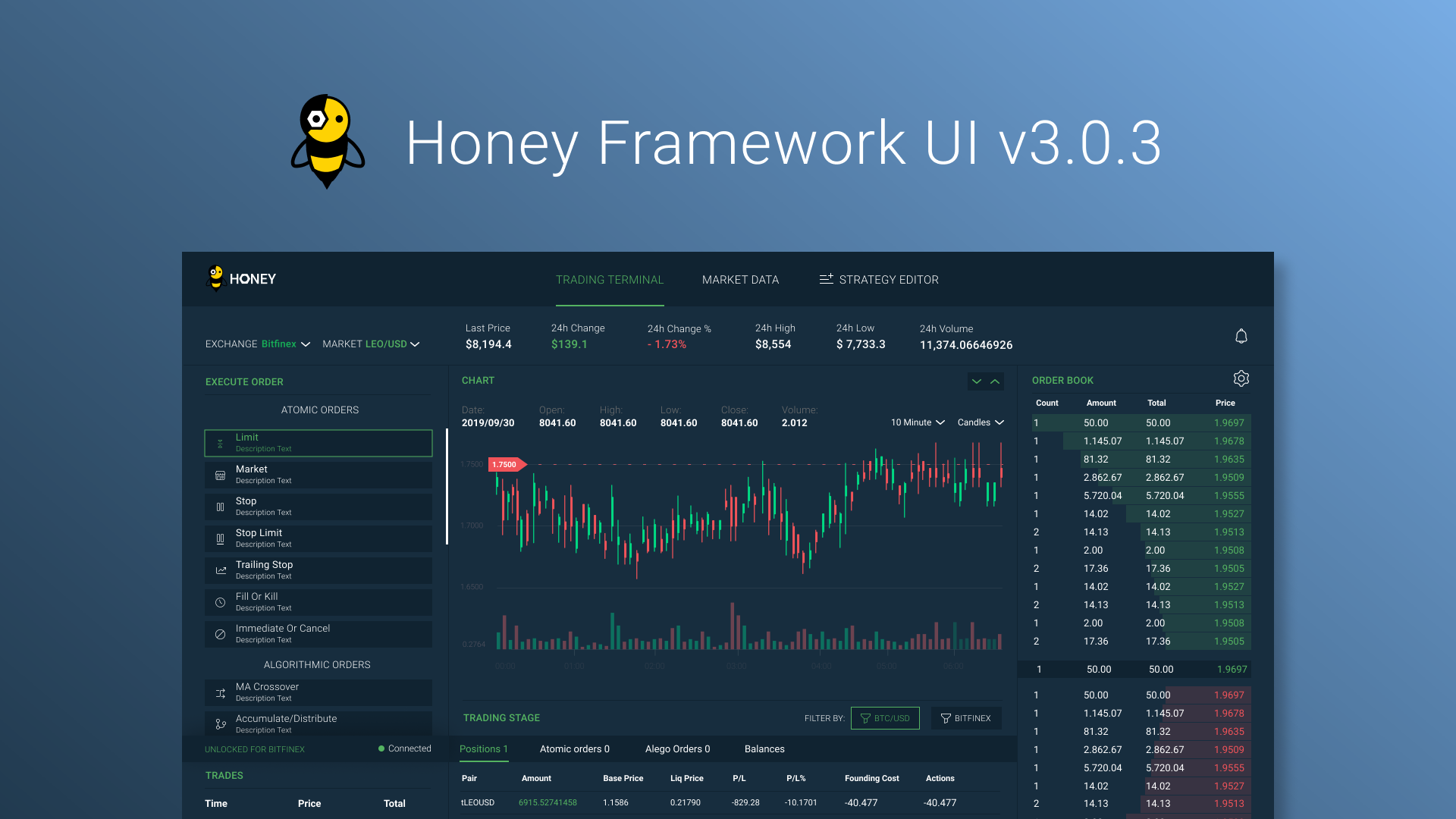

A couple of months ago we made the big announcement that we were going to release a new cool piece of technology called the “Honey Framework UI”, which aimed to package all of the power provided by the Honey Framework into a simple easy-to-install application.

Well, three months on and we have made some serious improvements, making the HF UI an even more powerful tool for our market participants utilize. In this tutorial, we are going to look at how to install the software, authenticate ourselves and use all of the new features that have been added in version three!

Step 1: Install the application

The Honey Framework UI has been developed using electron making it easy for us to distribute to our Mac, Windows and even Linux users. To download the version for your operating system, navigate to our Github releases page and install the latest clients.

- Mac OS (version 3.0.3) — click here

- Windows (version 3.0.3) — click here

- Linux (version 3.0.3) — click here

If you are having any troubles with the pre-built images then please try building the electron application yourself. There is info on how to achieve this in the repo readme.

Step 2: Create a password and add API keys

Once you have downloaded one of the above releases you can go ahead and start the application. On initial load you will be prompted to set a custom password which will be used to encrypt all of your personal data (including your strategies). You will now have access to the trading terminal, market data, and strategy editor pages.

In order to unlock full access to the app, you will have to also add your API credentials, which the Honey Framework will use to execute authenticated commands. To do this click on one of the order types within the “Trading terminal” which will prompt a form asking for both your API key and secret.

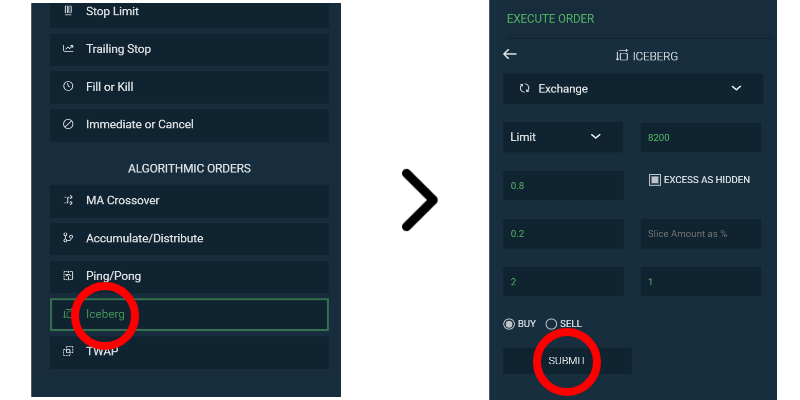

Step 3: Execute algorithmic orders

The trading terminal is one of the many new features in version three and houses most of the functionality of the application. Here you are able to create/update/cancel both atomic and custom algorithmic orders whilst viewing live trades, candles and orderbook updates. To execute your first algorithmic order first select an order type from the list:

Step 4: Custom market data layout

With version three, we really wanted to make the Honey Framework UI a more relevant tool that our users can take advantage of, even if they are not planning to use the Honey Framework algo order execution or strategy engine. To do this we included a market data page which consists of a customisable layout and a bunch of useful widgets that users can add/remove to craft the perfect place to monitor the markets. Users are able to create multiple layouts for different market conditions and reload them whenever.

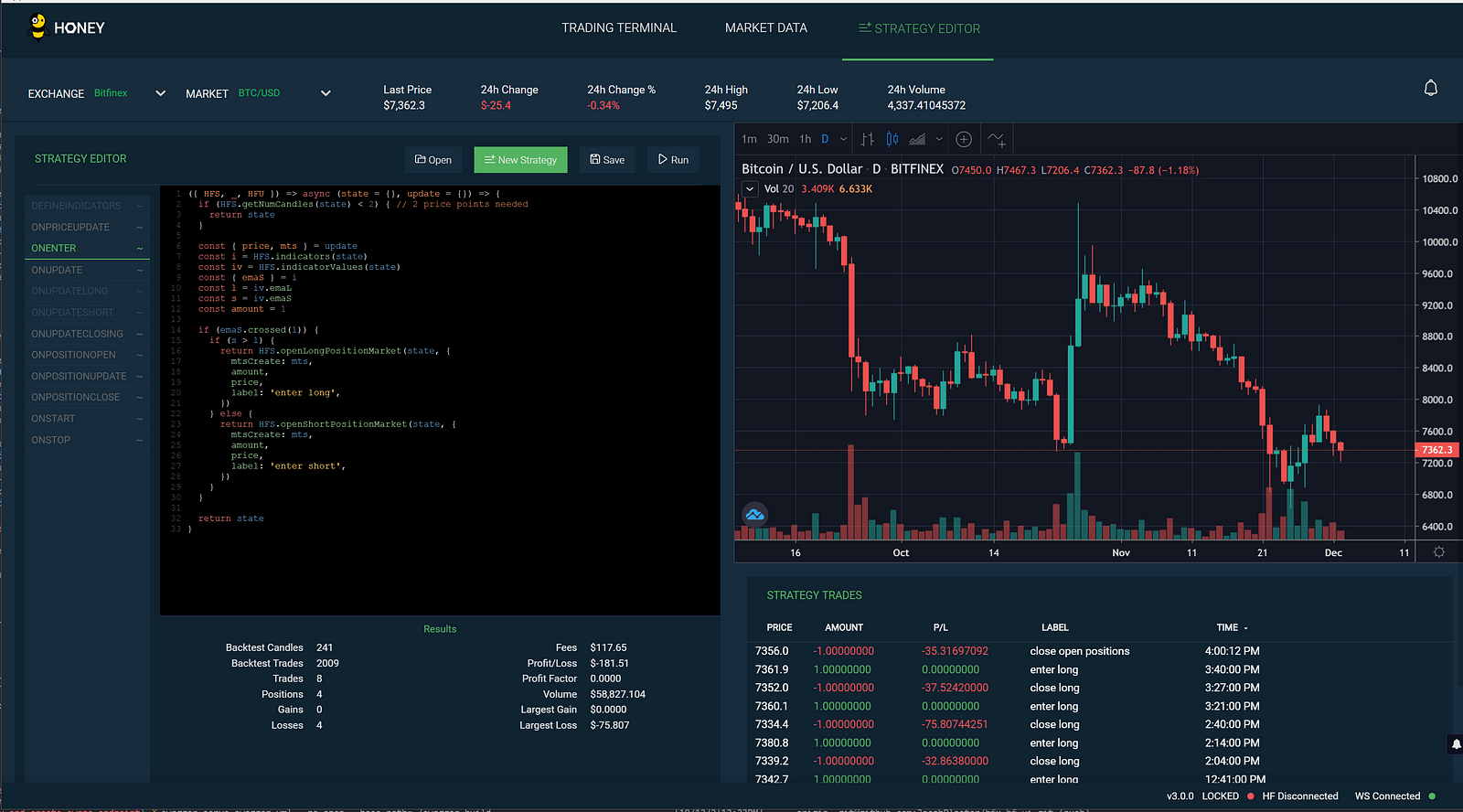

Step 4: Create an algorithmic trading strategy

As well as algorithmic orders, the Honey Framework is capable of managing and executing trading strategies. With over 20 different TA indicators built-in and custom backtesting, the strategy execution engine is perfect for all kinds of strategies such as arbitrage, market making, momentum, directional and a lot more.

To make this feature more valuable to our traders we designed and added an editor page which makes backtesting and coding your strategy from within the app a breeze. Simply navigate to the strategy editor page and pick from one of our example models or begin coding your own from scratch.

Thanks for reading

If you would like to contribute to the project then please just open a pull request to https://github.com/bitfinexcom/bfx-hf-ui.

For tips on how to use the bare metal version head here and finally, for tips on how to create an advanced automated trading strategy using HF head here.