15 Sep Bitfinex Alpha | Bitcoin Rebounds as Stagflation Pressures Mount

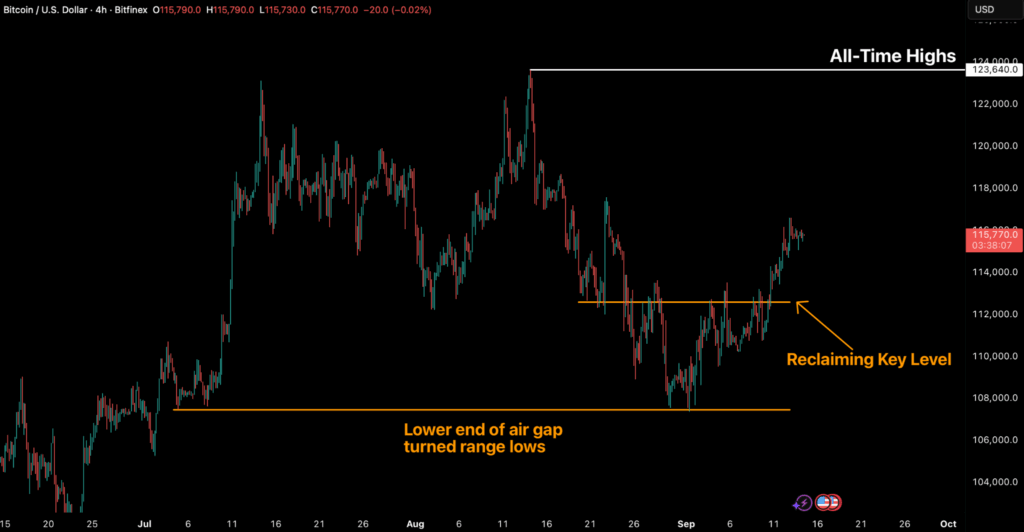

Bitcoin closed the week 4.2 percent higher, breaking a three-week decline and reclaiming the critical $112,500 support level after defending the $107,500 range lows. This rebound from the lower end of the gap marks an important structural recovery, setting the stage for stability into late September and potentially stronger upside momentum in Q4. On-chain data supports this backdrop: the cost-basis distribution heatmap highlights clear dip-buying around $108,000, while supply clusters between $110,000 and $116,000 now define the short-term range. A decisive move above $116,000 would confirm renewed momentum; until then, consolidation remains the base case.

Cohort behaviour reveals that 3–6 month holders realised $189 million in daily profits on average, accounting for nearly 80 percent of all short-term holder selling during the rebound. This profit-taking has acted as a near-term headwind, yet overall market structure remains constructive. Total crypto market capitalisation rose 4.8 percent this week to $3.97 trillion, reflecting a cautious but persistent accumulation bias. While volatility persists, both BTC and the broader market appear to be stabilising, with conditions aligning for a recovery phase once resistance levels are cleared.

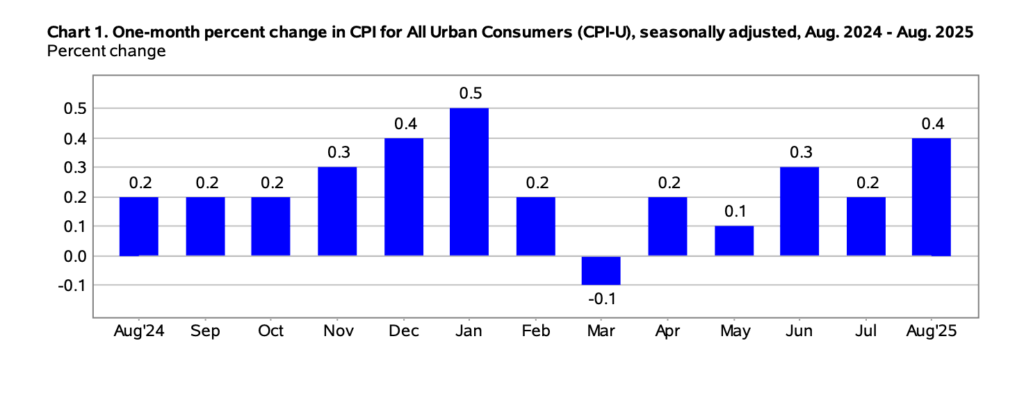

US economic conditions are increasingly defined by a delicate balance between stubborn inflation, weakening labour markets, and resilient—yet fragile—consumer behaviour. August’s Consumer Price Index showed the sharpest increase since January, with broad-based gains in housing, food, and energy costs, much of it driven by tariffs and supply disruptions. At the same time, the labour market has softened considerably, with jobless claims climbing to their highest level since 2021 and payroll revisions revealing that employment growth was overstated by nearly a million jobs.

Shifting to the household level, the same tensions are playing out in sentiment and spending. Consumer confidence fell to its lowest reading since May, reflecting concerns about inflation and job security, while inflation expectations remain elevated. Yet despite this gloom, spending patterns reveal resilience, with credit use expanding and households largely keeping up with their financial obligations. Families are drawing on savings and credit to maintain consumption, sustaining growth in the near term but raising questions about sustainability if wage growth continues to lag. Together, these dynamics highlight a fragile equilibrium: policymakers are caught between inflation control and employment support, while households are stretching to preserve purchasing power.

Meanwhile, the digital asset sector is seeing rapid shifts across exchanges, regulators, and corporates. In the US, Cboe plans to launch “Continuous Futures” for Bitcoin and Ether this November, offering long-term exposure within a regulated framework. Hong Kong, meanwhile, is proposing to ease capital rules for banks holding compliant digital assets, aiming to attract institutions while keeping strict buffers for riskier tokens. On the corporate front, Cyprus-based Robin Energy completed a $5 million Bitcoin allocation, briefly sending its stock up more than 90 percent. Together, these moves highlight how crypto is becoming more embedded in global finance, through regulated markets, evolving policy, and corporate adoption.