07 Jul The Importance of P2P Trading in Emerging Markets

Bitfinex launched a new peer to peer (P2P) crypto trading platform for citizens in Colombia, Argentina, and Venezuela this month. We look at how P2P trading is not just a useful way to acquire crypto assets, but also a key driver behind global crypto adoption. This is particularly the case in developing markets, where P2P grants instant open access to financial services and markets for the unbanked.

Adoption From the Ground Up Begins Locally

Many longtime Bitcoiners and crypto enthusiasts have fond memories of acquiring their first BTC or ETH – usually from a peer to peer (P2P) trading platform like LocalBitcoin or LocalCryptos – and involving a meeting with a stranger in a coffee shop and trading for cash. As the markets have matured and many nations and jurisdictions have adopted regulatory guidelines, full-service centralised trading exchanges have now become the “go to” method for trading digital assets.

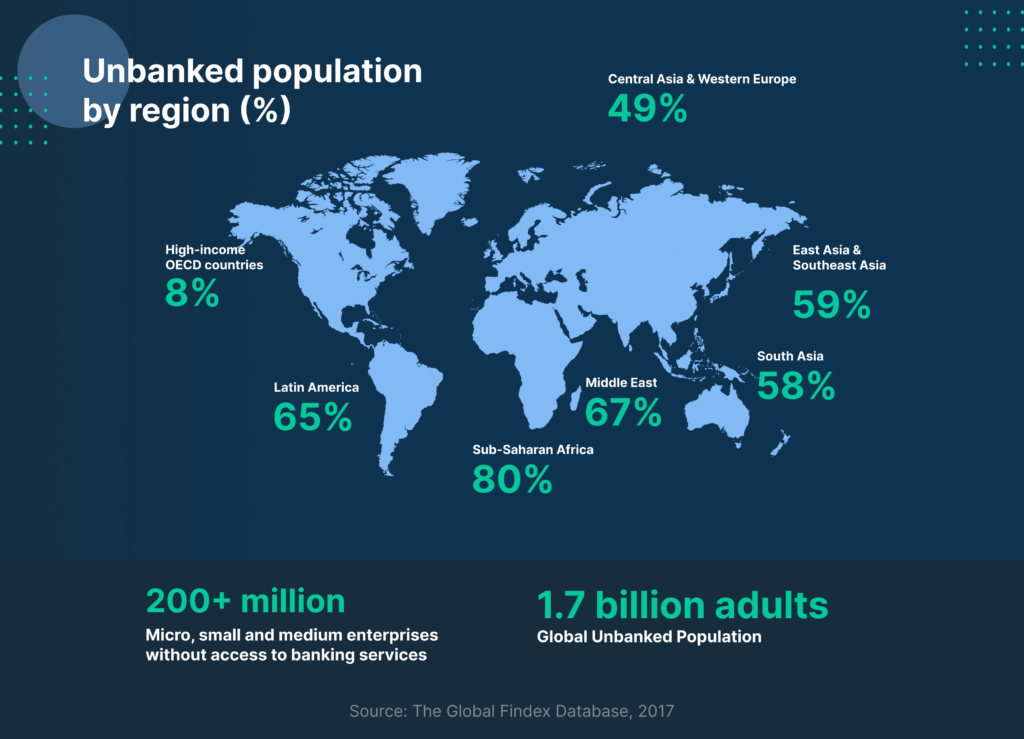

However, in emerging markets, where grass roots adoption is still growing exponentially, P2P markets never went out of style. On the contrary, they are often the predominant way that people buy and sell Bitcoin and crypto tokens. This should come as no surprise, as the lion’s share of the world’s almost 2 billion unbanked reside in emerging economies.

P2P crypto markets offer a trust-minimised way to buy and sell digital assets, dealing with complete strangers, utilising escrow services, reputation systems, and dispute moderation to ensure that bad actors cannot abscond with user funds. This is a crucial and necessary service in regions without regulatory clarity, access to exchanges and liquidity, and with small, local, groups of early adopters using crypto in communal settings.

P2P markets offer access to digital assets that would be otherwise unobtainable. Digital assets in turn, offer access to goods and services that are inaccessible or unobtainable domestically. They grant the unbanked the ability to make and receive digital payments, make purchases online, receive remittances, and procure goods, and services from abroad, which are available only in international markets.

For those who do not have access to bank accounts, credit cards, or payment apps, assets such as Bitcoin, Ethereum and Tether are literally lifelines. In countries like Argentina, Colombia, Cuba, Nigeria, Pakistan, and Vietnam, where there is either low access to financial services or an onerous amount of bureaucracy in order to conduct simple financial transactions like money transfers or even payments, crypto assets provide a practical workaround to overcome these barriers. People living in these places are energetic enthusiasts and often tell their family and friends how to onboard and benefit from these open financial networks.

Approximately, 92 percent of the world’s population reside in Latin America, Africa, and Asia. See below on why P2P trading is central to the explosion of crypto adoption in these emerging markets.

Latin America

As we covered in our article on the state of crypto adoption in Latin America, LATAM seems to be leading the race towards mainstream crypto adoption. El Salvador stands out as the most obvious example, with its Bitcoin legal tender law, Bitcoin office, Bitcoin embassies, and Digital Securities law, having set the bar for adoption high and laying out the template for nations that wish to follow suit.

Aside from El Salvador, Latin America seems to offer the perfect cocktail for grass roots adoption, including suffering from high inflation, strong demand for remittances, and having youthful, educated, technically proficient populations with a lack of access to financial services, or very limited access.

Latin American nations like Argentina, Brazil, Colombia, and Venezuela have all seen a huge increase in demand for digital assets like Bitcoin and USDt as a way to preserve purchasing power amidst the instability of national currencies, and high inflation. Each of these countries have historically had thriving P2P trading markets with volumes being some of the highest in the world.

This trend of rapidly growing grass roots crypto adoption, nation state adoption, and weakening economic conditions is only expected to continue as P2P trading continues to be the primary way in which adopters trade digital assets. We expect a variety of innovative new services to emerge as classic fintech and digital assets continue to blur the lines and merge together.

Africa

Africa faces many of the same hurdles and challenges as those in Latin America, in that weak national currencies, high inflation, and political instability have been catalysts for a high degree of grass roots crypto adoption. Like Latin America, a majority of the region’s digital asset trading volume takes place in P2P markets.

Nigeria leads the African continent for crypto adoption, with an estimated 10.34 percent of the population owning digital assets. Nigeria is ranked 11th globally for crypto adoption, and is joined by Kenya and Morocco on Chainalysis’ 2022 list of the top 20 countries around the world leading crypto adoption.

Africa’s P2P trading markets make up 6% of all crypto transactions, worldwide. Sub-Saharan Africa also leads the world in crypto payments for retail purchases, with 80 percent of the world’s retail payments of less than $1000, being made within the region.

On the regulatory front, South Africa and Mauritius lead the continent with regulatory frameworks in place, as well as market oversight from financial authorities. Africa stands to be one of the regions that could benefit the most from widespread crypto adoption, as the lack of access to financial services is more extreme than in other regions.

Crypto adoption is likely the fastest and least resource-intensive way to provide large scale financial inclusion to huge segments of the unbanked populations throughout almost every nation on the continent. Crypto provides opportunities to citizens who may not have other options for income amidst high unemployment, economic difficulties, political turmoil, and weak national currencies.

Asia

Asia is a massive region with an educated, digitally native, tech savvy and youthful population, which is spearheading adoption at an ever increasing pace. Leading the world in grass roots crypto adoption is Vietnam, with the Philippines, Thailand, Pakistan, and India not far behind. It is estimated that 21 percent of Vietnamese citizens use or own crypto, and the situation in the Philippines is similar with an estimated 20 percent of the population owning or using digital assets.

Remittances are a major contributor for this adoption, as a cheaper, more convenient way for members of the Asian diaspora abroad, to send money to family back home. Another lesser known contributor to the high levels of grass roots adoption has been DeFi adoption, yield farming, NFTs, and play to earn gaming, which have been popular among the region’s youth, as ways to earn income.

P2P trading has been the primary driver behind the huge trading volumes seen in Asian nations, in which citizens often do not have access to formal exchanges. In nations like India and where regulations have not been “friendly” to crypto, or Pakistan which is considering an outright ban for digital assets, grass roots adoption has not been slowed, with trading taking place through P2P services.

The enthusiasm for crypto is perhaps unrivalled in Asia, as populations who are tech savvy and used to digital payments via apps like Alipay and Wechat, discover decentralised alternatives offering financial inclusion, access to international markets, and perhaps even an opportunity to trade and make a profit. Moving forward, Asia will continue to be a hotspot for adoption and innovation, as adopters find new use cases and financial opportunities in crypto.